The study examined 187 SMEs in Ghana using the panel data methodology. The pecking order claims that the least preferred method is through equity financing.

Variables And Measures Used In The Trade Off Theory Test Download Table

Variables And Measures Used In The Trade Off Theory Test Download Table

Pecking order theory suggests that companies should prioritise the way in which they raise finance.

Trade off theory vs pecking order. According to pecking order theory the order of financial sources used is the source of internal funds from profits short-term securities debt preferred stock and common stock last. Pecking order theory and the determinants of corporate leverage. Moreover the pecking order seems to explain why profitable firms have low debt ratios.

This article empirically tests the two competing theories of capital structure. Fama and French criticized both the trade-off theory and the pecking order theory in different ways. Pecking-order theory focuses on financing from internal funds and using external funds as a last resort.

Hence the theory that fits best the SMEs corporate leverage strategy is a controversial issue. However pecking order theory promotes that companies tend to issue debts when company has internal financial deficit or deviation from target capital leverage. Trade-Off Theory versus Pecking Order Theory.

In this sense they find that trade off theory considerations help firms determine their debt capacity while pecking order theory describes firms preferences between different methods of financing. Describe a specific business that seems to follow trade-off theory and another that follows pecking-order theory3. We test 2370 French SMEs over the period 20022010 and compare our results with that of other French studies.

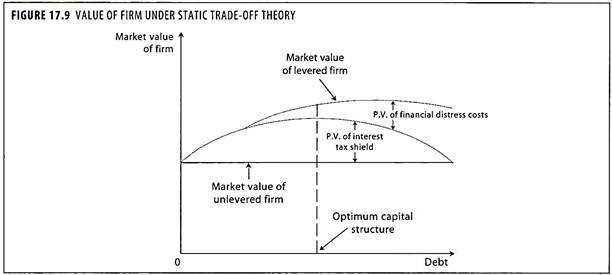

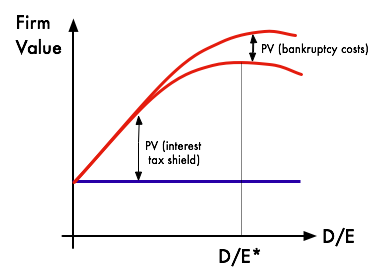

The trade-off theory predicts optimal capital structure while the pecking order theory does not predict an optimal capital structure. Evidence from a panel data analysis upon French SMEs 20022010 Philippe Adair1 and Mohamed Adaskou2 Abstract. Capital structure decisions in a peripheral region of Portugal.

The dependent variable being the debt. Each plays a role in the. Thus unlike the trade-off theory the pecking order theory is capable of explaining differences in capital structures within industries.

It has developed into trade-off theory TOT whereas pecking order theory POT is its main challenger. This study is performed for an emerging market context taking the case of Indian firms with a sample from 10 industries for the period 1990 to 2007. In trade-off theory it helps to determine the debt proportion and maintain optimal balance in order to maximise companys market value.

Based on empirical findings around the world both the static trade-off and the pecking order theories are evident in capital structure decision making. We test the assumptions of trade-off theory TOT and pecking order theory POT regarding corporate leverage. Journal of Business Economics and Management.

The net income approach static trade-off theory and the pecking order theory are three financial principles that help a company choose its capital structure. These theories were first developed by Kraus and Litzenberger in 1973 and Donaldson in 1961 respectively and they make part along with Neutral Mutations. The objective of this study was to examine the theoretical predictions of the pecking order theory and the trade-off theory to establish which of the two competing theories better explains the financing decisions of small and medium enterprises SMEs.

Trade-off theory focuses on bankruptcy cost and debt which states there are advantages to debt financing. Trade-off Theory vs Pecking Order Theory. Trade-off theory against Pecking Order theory using the time series hypothesis.

Nevertheless the contrast between the two theorist is the Trade Off theory argues the effective measure of tax shield for corporations for the business to be successful whilst Pecking Order theory debates that with equity the business can be effective and efficient when allowance is made for the issue of new shares. Pecking-Order and Trade-off TheoriesSeveral theories are proposed to explain how companies deal with debt and financial distressQUESTIONS1. Trade-off theory has dominated corporate finance circles.

According to pecking order theory the order of financial. Welch has argued that firms do not undo the impact of stock price shocks as they should under the basic trade-off theory and so the mechanical change in asset prices that makes up for most of the variation in capital structure. Compare and contrast trade-off theory and pecking-order theory.

However dynamic trade-off and market timing. The pecking order theory performs satisfactorily for large firms firms with rated debt and when the impact of debt capacity is accounted for 2009. The pecking-order theory assumes there is no capital structure.

The pecking order relates to the hierarchy that the company follows from the most appropriate to the least. The trade-off theory predicts optimal capital structure while the pecking order theory does not predict an optimal capital structure. Weekly Assignment – Week 6 In this essay we are up to discuss about Capital Structure Policy Models specifically about the two mentioned above.

This happens not because they have low target debt ratios but because they do not need to obtain external financing.

Predicted Sign Of Variables By Pecking Order Theory Vs Trade Off Theory Download Table

Predicted Sign Of Variables By Pecking Order Theory Vs Trade Off Theory Download Table

Pdf Pecking Order Theory And Trade Off Theory Of Capital Structure Evidence From Indonesian Stock Exchange

Pdf Pecking Order Theory And Trade Off Theory Of Capital Structure Evidence From Indonesian Stock Exchange

Pdf Trade Off Theory Versus Pecking Order Theory Ghanaian Evidence

Pdf Trade Off Theory Versus Pecking Order Theory Ghanaian Evidence

Pdf Testing Static Trade Off Theory And Agency Theory For German Firms Semantic Scholar

Pdf Testing Static Trade Off Theory And Agency Theory For German Firms Semantic Scholar

Trade Off Theory Of Capital Structure Wikiwand

Trade Off Theory Of Capital Structure Wikiwand

Pdf Traditional Trade Off V S Pecking Order Which Is A Better Theory

Pdf Traditional Trade Off V S Pecking Order Which Is A Better Theory

Pdf Trade Off Theory Against Pecking Order Theory In A Nested Model Panel Gmm Evidence From South Africa

Pdf Trade Off Theory Against Pecking Order Theory In A Nested Model Panel Gmm Evidence From South Africa

Predicted Signs Of Variables Under Trade Off Theory And Pecking Order Download Scientific Diagram

Predicted Signs Of Variables Under Trade Off Theory And Pecking Order Download Scientific Diagram

Pdf Testing Pecking Order Theory And Trade Off Theory Models In Public Companies In Indonesia

Pdf Testing Pecking Order Theory And Trade Off Theory Models In Public Companies In Indonesia

Pdf The Pecking Order Theory And The Static Trade Off Theory Comparison Of The Alternative Explanatory Power In French Firms Semantic Scholar

Pdf The Pecking Order Theory And The Static Trade Off Theory Comparison Of The Alternative Explanatory Power In French Firms Semantic Scholar

Pdf Trade Off Theory Vs Pecking Order Theory And The Determinants Of Corporate Leverage Evidence From A Panel Data Analysis Upon French Smes 2002 2010

Pdf Trade Off Theory Vs Pecking Order Theory And The Determinants Of Corporate Leverage Evidence From A Panel Data Analysis Upon French Smes 2002 2010

Pdf Pengujian Trade Off Theory Dan Pecking Order Theory Di Jakarta Islamic Index

Pdf Pengujian Trade Off Theory Dan Pecking Order Theory Di Jakarta Islamic Index

Pdf Trade Off Theory Vs Pecking Order Theory Saul Costa Academia Edu

Pdf Trade Off Theory Vs Pecking Order Theory Saul Costa Academia Edu

The Capital Structure Through The Trade Off Theory Evidence From Tunisian Firm Semantic Scholar

The Capital Structure Through The Trade Off Theory Evidence From Tunisian Firm Semantic Scholar

Trade Off Theory Versus Pecking Order Theory Capital Structure Decisions In A Peripheral Region Of Portugal Semantic Scholar

Trade Off Theory Versus Pecking Order Theory Capital Structure Decisions In A Peripheral Region Of Portugal Semantic Scholar

Pdf Trade Off Versus Pecking Order Theory In Listed Companies Around The World Semantic Scholar

Pdf Trade Off Versus Pecking Order Theory In Listed Companies Around The World Semantic Scholar